BJP-led government has significantly liberalised income tax slabs, taken steps for welfare of middle class: Sitharaman in Lok Sabha

X

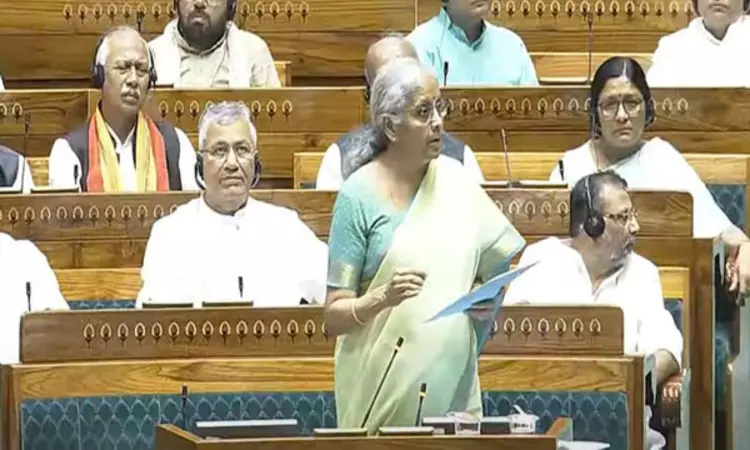

XFinance Minister Nirmala Sitharaman in Lok Sabha (ANI)

NEW DELHI: Finance Minister Nirmala Sitharaman on Wednesday said that the government has taken several steps to provide relief to the middle class and said the slabs for personal income tax were significantly liberalised in 2023.

Replying to the debate on the Finance Bill in the Lok Sabha, Sitharaman said the BJP-led government has again revised slabs in the new tax-filing regime in the Union Budget presented last month.

Noting that the goernment led by Prime Minister Narendra Modi did not put additional tax burden during the Covid to meet government expenditure, she said the approach is to simplify taxation and reduce the burden on taxpayers.

Replying to the opposition members who repeatedly accused the government of burdening taxpayers both through direct and indirect taxes, she said that government has raised standard deduction for salaried employees, increased the limit of exemption of capital gains on certain listed financial assets and abolished angel tax.

"Standard deduction for salaries employees has also been increased from Rs 50000 to Rs 75000 in the new regime in this budget. This is an effective relief up to Rs 17500 for a salaried employee," she said "

In 2023, the slabs for personal income tax were significantly liberalised. All tax payers had reduced tax liability of Rs 37500. This govt has again revised slabs in the new regime," she added.

The minister said that these steps will benefit middle class.

For the benefit of the lower and middle-income classes, Sitharaman in her Budget speech on July 23 proposed to increase the limit of exemption of capital gains on certain listed financial assets from Rs 1 lakh to Rs 1.25 lakh per year.

Coming to personal income tax rates, she had two announcements will help those opting filing returns under new tax regime.

First, the standard deduction for salaried employees is proposed to be increased from Rs 50,000 to Rs 75,000. As a result of these changes, a salaried employee in the new tax regime stands to save up to Rs 17,500 in income tax. Similarly, deduction on family pension for pensioners is proposed to be enhanced from Rs 15,000 to Rs 25,000.

This, she said, will provide relief to about four crore salaried individuals and pensioners.

The Lok Sabha took up discussion on the Finance Bill after the Appropriation Bill for the central government's expenditure for 2024-25 was passed by the House on Monday.

The passage of the Finance Bill by Parliament will complete the budget process.

The Finance Minister has proposed an amendment in the Finance Bill to give big relief on capital gains tax in property transactions.

The proposed amendment implies that taxpayers on property transactions can avail either a lower tax of 12.5 per cent without indexation or a higher rate of 20 per cent with indexation, if the property is acquired before July 23, 2024, the day the union budget was presented in the Lok Sabha. July 23, 2024, is now set as the cut-off date for the calculation of the capital gains versus the earlier cut-off of 2001 that had caused a lot of concern and triggered a debate over its impact on long-time owners of property assets.

To bolster the Indian start-up eco-system, boost the entrepreneurial spirit, and support innovation, Finance Minister Nirmala Sitharaman in her Budget speech proposed to abolish the so-called angel tax for all classes of investors.

This was a proposal from the industry for a long time, and this announcement is expected to drive more investments toward startups in particular. Startups function as engines of economic growth, playing a crucial role in generating new jobs, ideas, products, and services. As per definition, angel tax refers to the income tax levied by the government on funding raised by unlisted companies, or startups, if their valuation exceeds the company's fair market value.

Sitharaman presented the Union Budget 2024 in Parliament on July 23, marking her seventh consecutive budget and eclipsing the late Moraji Desai's record of six consecutive budgets.

The interim budget, tabled on February 1, took care of the financial needs of the intervening period until a government was formed after the Lok Sabha polls.

The budget session of Parliament began on July 22 and, according to schedule, will end on August 12.