Hyundai Motor India Ltd has made headlines with its initial public offering (IPO), which opened for subscription on October 15, 2024, and is set to close on October 17, 2024.

On the first day of bidding, the IPO saw an 18 per cent subscription rate, which increased to 42 per cent by the second day on October 16, 2024.

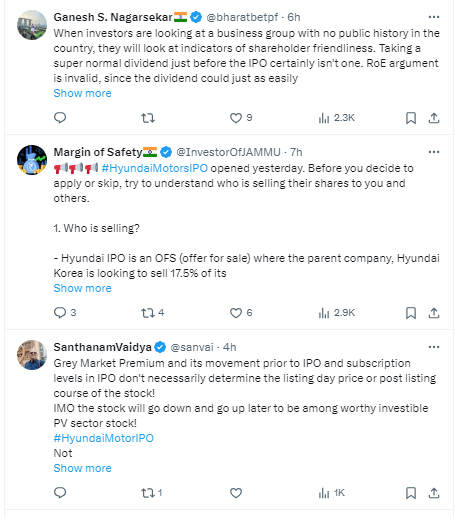

Social Media Perspectives

The discussion around Hyundai's IPO has been particularly lively on social media platforms.

Vivek Singhal, founder of VSpartans Consultants Pvt Ltd, taking to the social media platform X, formerly Twitter, expressed about the intentions behind the IPO.

In his post, he wrote, "Why are Hyundai’s promoters coming up with the IPO that is the largest ever in Indian history? Ans: to take back home more than $3 billion. This is a hundred percent offer for sale issue. They are not raising any money for expansion or working capital requirement. Promoters are simply diluting their stake."

Why Hyundai’s promoters are coming up with the IPO that is largest ever in Indian history?

Ans: to take back home more than $3 billion. This is hundred percent offer for sale issue.

They are not raising any money for expansion or for working capital requirement.

Promoters are…— Vivek Singhal (@TheVivekSinghal) October 16, 2024

Singhal, in his post further noted out that that while the IPO is being offered at a reasonable price-to-earnings (PE) ratio of 26, it primarily serves as a means for promoters to cash out rather than to fund growth. He added, "This means fair chances that anchor investors would be exiting whenever their lock-in period ends."

Hyundai Motor India IPO Day 2: ₹27,870 Cr Offer Sees 42% Subscription

Deepak Shenoy, founder and CEO of Capital Mind, also added an additional context. Taking the platform X, Shenoy wrote, "It's only an Offer for Sale: versus giving the company money, you're letting the shareholder (Hyundai Korea) exit."

There are opinions about the Hyundai IPO, and I'm not going to recommend or otherwise, but two nuances you must note

Oh, it’s only an Offer for Sale: versus giving the company money, you’re letting the shareholder (Hyundai Korea) exit.

You actually want companies that don’t…— Deepak Shenoy (@deepakshenoy) October 16, 2024

He further in his post added that the dynamics of IPOs that are primarily offers for sale, noting out that potential investors should evaluate whether they are comfortable buying shares from existing shareholders rather than contributing capital for growth.

Shenoy further in his post wrote, "There are other concerns – a higher royalty will be paid to the Korean parent from this year onwards. The car market has not yet found its glory days. Hyundai faces more competition in India, especially in the electric segment."

‘Road Tax Isn’t Parking Charge’: Finfluencer Anupam Gupta’s X Post Sparks Call For Heavy Charges On Private Car Parking In Mumbai; Netizens React

Netizens’ Reactions

As the discussions continued, netizens took to social media to express their opinions.

An X user commented, "Invest only if you have conviction in future prospects. Most of the money is taken out to the Parent group."

Another user added, "Hyundai's promoters launch India's largest IPO ($3B) via 100% offer-for-sale, diluting stake without fundraising for expansion. Reasonable PE ratio (26) attracts anchor investors ($1B) with 30-90 day lock-in. Potential exit post-lock-in may impact stock performance."