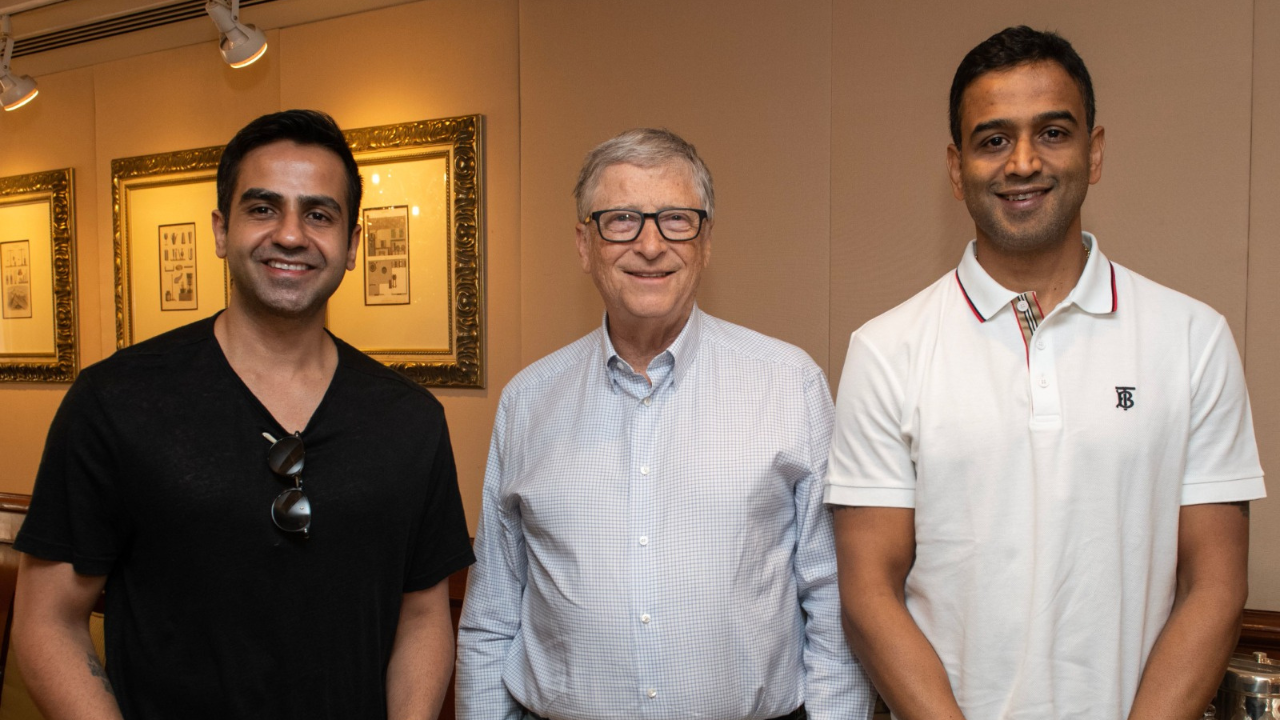

Discount broking firm Zerodha, helmed by Nithin and Nikhil Kamath, has made some adjustments to its investment portfolio in the June quarter of 2024. The firm reduced its stake in the Bombay Stock Exchange (BSE) and added Radico Khaitan, a leading spirits company, to its holdings.

Zerodha trimmed its BSE stake from 23.3 lakh shares (1.72%) in March 2024 to 19.8 lakh shares (1.46%) by June. This move came after BSE's remarkable performance, with a 28% gain year-to-date (YTD), a 209% rise over the past year, and an astonishing 667% increase over three years. Zerodha's current stake in BSE is valued at approximately Rs 563 crore.

Related News |

Mcap of 8 of Top-10 Most Valued Firms Surge Rs 1.53 Lakh Crore; Airtel, Infosys Biggest Gainers

In contrast, Zerodha has bolstered its portfolio by acquiring 13.9 lakh shares (1.04%) of Radico Khaitan, known for popular brands such as Magic Moments vodka and 8PM whisky. While Radico Khaitan has seen a modest 8% YTD gain, its value has grown by 45% over the past year. The broking firm's investment in the company is now worth around Rs 271 crore.

Zerodha's other investments displayed mixed results. CarTrade Tech remained unchanged in the portfolio and delivered a 16% YTD gain and a 48% rise over the last year. RBL Bank, however, faced a decline, down 21% YTD and 5% over the past year. Federal Bank, where Zerodha maintained its position, outperformed, with a 25% YTD gain and a 36% increase over the past year.

Axis Securities, noting Federal Bank's strong rally, reiterated its buy rating with a target price of Rs 230, suggesting an 18% upside from its current price of Rs 195.

The total value of Zerodha's listed stock portfolio stands at Rs 1,536 crore, while the Kamath brothers' net worth is estimated at Rs 41,000 crore according to the Hurun India Rich List 2024.

Related News |

Mumbai Man Loses Rs 90 Lakh In WhatsApp Investment Scam: How To Protect Yourself

(Disclaimer: The above article is meant for informational purposes only, and should not be considered as any investment advice. Times Now Digital suggests its readers/audience to consult their financial advisors before making any money related decisions.)